I am woefully late in coming to this understanding that monopoly is the goal of all venture capital. Peter Thiel, of Paypal, Palantir, Facebook “fame,” literally said this was the goal, in front of God and everyone, in a WSJ op-ed, seven years ago. Like the PG article from the other day, Thiel tells some whoppers to try to make everyone feel better about monopolies.

Even the government knows this: That is why one of its departments works hard to create monopolies (by granting patents to new inventions) even though another part hunts them down (by prosecuting antitrust cases). Source: Peter Thiel: Competition Is for Losers – WSJ

If this isn’t the most-lopsided statement I’ve ever seen, I don’t know what would beat it. First of all, the patent office does not “work hard.” An awful lot of patents are given out like candy for trivial things. Further, software patents — which I’m sure Thiel loves — have been one of the most business-stifling things to ever happen in modern history.

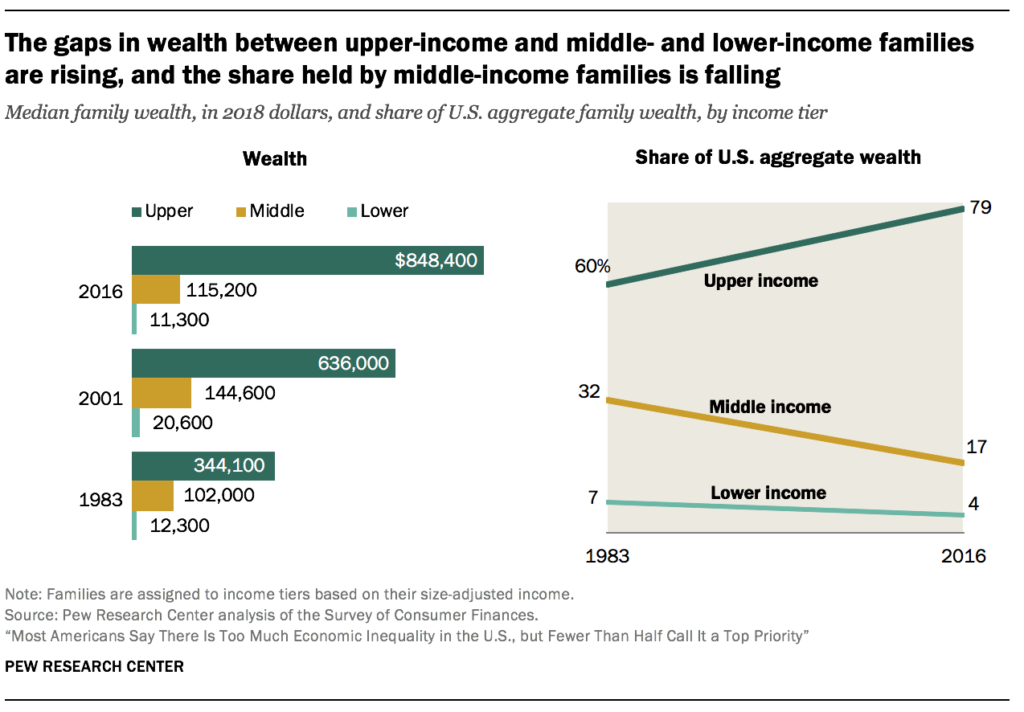

Second of all, the government has only ever stopped the very biggest deals. It would seem that the current “gentleman’s agreement” is that anything under about $30B isn’t worth talking about. So Microsoft buys LinkedIn and Skype and GitHub, when it doesn’t really make much sense for them to own any of them. All the FAANG companies run around, picking up interesting toys in the flea-market bins marked “less than $1B,” and the government doesn’t even bat an eye.

And the government certainly hasn’t broken up any monopolies since AT&T. Given that the “baby Bells” have all since re-merged into the duopoly of Verizon and AT&T — which, mysteriously, line up almost perfectly in their cell phone contract terms — I’m not sure that even this was worth the hassle for the customer. What I am sure of, is that lots and lots of executives pocketed lots and lots of money for all that M&A activity.

If your industry is in a competitive equilibrium, the death of your business won’t matter to the world; some other undifferentiated competitor will always be ready to take your place.

This reveals Thiel’s cognitive bias. These “undifferentiated competitors” — in his terminology — are small businesses that would make their owners a comfortable living, and provide good job opportunities in their local market. Yes, if it folds, someone else may come along and take your place. I feel that’s a humane cycle of life. Thiel thinks this is a tragic notion, when he can be the guy who provides the capital to corner a market, and then extract all the profits that would have gone to those smaller businesses.

Monopoly is therefore not a pathology or an exception. Monopoly is the condition of every successful business.

Bullcrap. Utter VC narrative-spinning bullcrap. There are millions of small businesses being run out of business or bought up to further fuel multi-national corporate behemoths, who were too big decades ago, in this twisted game to become the largest companies in the world.

History is going to judge this period in human development as the time where we either decide how big is “big enough,” or whether we become a planet of corporations instead of governments. We’re running out of time to make the call, and if we don’t, we will eventually get the latter.

You can say that it’s unethical to tell Peter Thiel, “No, you can’t have any more,” but if we find the collective will to start doing that to the billionaires of the world, in another generation, it will matter more which company you work for, than what nation you are a citizen of. It already does in China, where working for Apple — as detestable as the working conditions are to Americans — it’s still one of the best jobs in the country. It already does in Alabama, where working for Amazon was seen to be so good — despite all the press to the contrary — that they overwhelmingly rejected the call to unionize. Those people would work for Apple or Amazon no matter what country they had to do it from.

(Makes you wonder who was running all the pro-union stuff in social media, huh?)