I once had a strained conversation with a good friend over the concept of a wealth tax. I was for it; he was very much against it, on the grounds that most of the “wealth” we’re usually talking about is in the form of stocks, which are “paper money.” He feels that this sort of asset is useless unless sold and converted to cash, when it will be taxed, if any gains are realized, and all’s fair in love in war, so to speak.

But this viewpoint overlooks the fact that “paper money” is an asset that has an strongly-estimable value in the future, just as much as real estate. And that means it can be borrowed against. The way the world works, and the laws of increasing returns being what they are, a guy like Elon Musk can just ask the nearest national bank for several hundred million dollars in cash, pay essentially nothing for the service, and all he would need to do is throw a stack at the armored car company to deliver it to his house, where he could fill up the pool in the back yard with the bills, and dive into it like Scrooge McDuck.

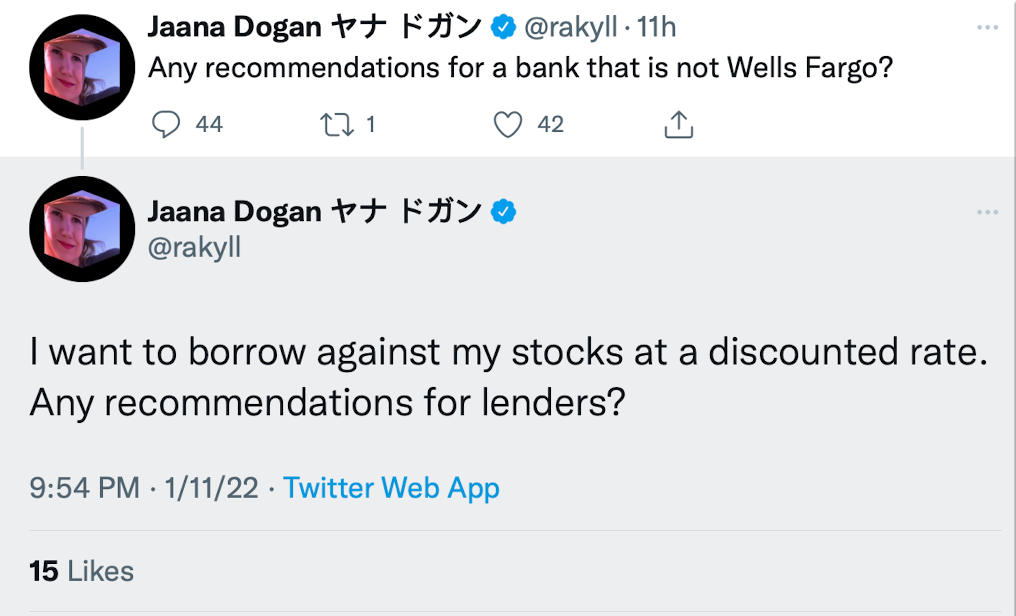

I mean, heck, I could do it, if I had a some short term need. I’m not going to get even Ms. Dugan’s rate, let alone Musk’s, but I could do it. I could borrow money against my portfolio, and use the money to pay for something like… college tuition. Oh, crap. This is probably a better option than actually dipping into the asset, huh?